Think of your website not just as a place to sell but as a fully optimized, frictionless payment hub. No one likes a complicated checkout process—customers expect fast, secure, and effortless transactions. This is where payment gateway integration becomes essential, acting as the invisible bridge between buyers and businesses, ensuring smooth and secure payments.

Adding a payment gateway to your website is not just about processing the transaction but instilling confidence in the customer so they can make their purchases effortlessly while the entire operation remains efficient. An optimized integration system would make checkout more convenient and trustworthy and reduce the chances of cart abandonment.

Mastering how to integrate a payment gateway can be a game-changer. Whether you want to set up an online store, deliver digital services, or manage subscriptions, getting the integration right ensures your business is working and your customers are satisfied. In this guide, we will walk through the crucial steps, best practices, and expert insights that will guide your payment gateway integration experience.

Understanding Payment Gateways

Integration of payment gateway is the most important aspect of any web-based business. A payment gateway is an encrypted link between a payor’s source of funds and a merchant bank account where secure and smooth transactions are processed in seconds only. It verifies payment details, settles authorizations and transfers funds in seconds only. Without integration, web payments would be cumbersome, insecure and error-prone.

How Payment Gateways Work

During the purchase process by a consumer, the payment gateway encrypts the payment details and forwards the details securely to the concerned financial intermediaries. The payment processor instructs the bank or payment network to accept the transaction or decline it. Once approved, the payment gets transmitted into the business account. Transactional convenience and industry-approved payments based on security standards are facilitated by payment platform integration.

Types of Payment Gateways

Choosing the right payment gateway depends on business needs. The two primary types are:

Hosted Payment Gateways:

- Redirect customers to an external payment provider’s secure page.

- Simplifiy compliance and security management, as the provider handles sensitive data.

- Common examples: PayPal, Stripe Checkout, and Skrill.

- Best suited for small businesses or startups looking for a quick and secure solution without handling complex payment security requirements.

Integrated (On-Site) Payment Gateways:

- Transactions happen directly on the business’s website, offering a seamless user experience.

- Require advanced security measures, such as PCI DSS compliance, but provide full control over branding and customization.

- Common examples: Stripe API, Authorize.net, and Braintree.

- Ideal for larger businesses that require a professional, fully branded checkout process.

It is an imperative of successful payment gateway integration to enhance consumer confidence and facilitate secure and seamless transactions. Regardless of whether a hosted solution or integrated platform is utilized, companies must emphasize efficiency, security, and user experience in implementing their payment platform integration in a bid to enhance conversions and preserve consumer confidence.

Choosing the Right Payment Gateway

Picking an appropriate payment gateway determines success or failure in an online business. With an endless number of gateways to sort through, business concerns need to exercise prudence in making a choice when implementing a system. Seamless payment gateway integration guarantees easy transactions, client satisfaction and retention, and user-friendliness.

Key Factors to Consider

When considering how to integrate a payment gateway into their business, companies should consider the following factors:

- Transaction Fees – Each payment gateway charges differently per transaction. Some have fixed percentages such as PayPal, but others use volume-based pricing such as Stripe. High-volume companies have to be on the lookout for such fees.

- Security Features – Encryption and fraud prevention and PCI DSS compliance are needed. A secured gateway protects client information and reduces chargebacks.

- Supported payment methods – The payment gateway should support multiple payment methods such as bank transfers, e-wallets (Google Pay and Apple Pay), and others such as cryptocurrency and bank transfers.

- Integration Issues – Some providers have plug-and-play options and others require custom development. It helps to have an idea on how to integrate a payment gateway in a site prior to selecting a provider.

- Settlement Time – Different providers have different times for moving money into a business account. Some payment gateways send payment in real-time and others take a few days.

Comparing Popular Payment Gateways

When businesses decide to integrate a payment gateway, they should compare industry leaders based on their features and pricing models:

- Stripe – Best for developers and businesses needing a highly customizable, API-driven integration.

- PayPal – A widely recognized provider with simple setup but higher transaction fees. Ideal for small businesses and international transactions.

- Square – Excellent for brick-and-mortar stores with an online presence, offering both POS and e-commerce solutions.

- Authorize.net – A solid choice for businesses needing a traditional merchant account with strong security features.

Selecting an appropriate gateway involves a compromise between user experience, security, and expense. An appropriate provider facilitates checkout easily and maintains the consumer engaged and the transaction secure.

Integration Process Detailed

Online payment gateway integration can be made to seem complicated, yet with an appropriate methodology, the payment process of the customers can be made smooth and trouble-free by the companies. Opting for either a hosted facility or an integrated API-based payment gateway platform, a step-by-step approach ensures an implementation free from complications.

Step-by-Step Guide to Integrate a Payment Gateway in a Website

- Choose the Right Payment Gateway

- Evaluate providers based on transaction fees, security, and ease of integration.

- Consider whether a hosted or direct integration suits your business model.

- Create a Merchant Account

- Some gateways require businesses to set up a merchant account to process transactions.

- Providers like Stripe and PayPal offer built-in merchant services, simplifying this step.

- Obtain API Keys

- After registration, the payment provider issues API keys, which authenticate communication between your website and the gateway.

- Most providers offer separate keys for testing (sandbox mode) and live transactions.

- Integrate Payment Gateway in Website

- Hosted gateways require simple redirection to an external payment page.

- API-based integrations require backend setup to process payments directly within the site.

- Implement Payment Processing Workflows

- Configure the gateway to handle different transaction types: one-time payments, subscriptions, refunds, etc.

- Ensure error handling is in place to manage failed transactions or payment declines.

- Test the Payment System

- Use sandbox mode to simulate real transactions before going live.

- Check for potential failures, security vulnerabilities, and user experience issues.

- Go Live and Monitor Transactions

- Once testing is complete, switch to live mode and monitor real transactions.

- Set up alerts for failed payments or suspicious activity.

Technical Considerations for Payment Gateway Integration

- APIs and SDKs – Most modern payment processors, including Stripe, PayPal, and Square, have powerful APIs and SDKs in development languages such as Python, JavaScript, and PHP to simplify development.

- Backend Configuration – Companies utilizing API-based gateways need to set up secure backend processing to manage payment requests and verify responses.

- Security Compliance – Stay PCI DSS compliant by encrypting transaction data and facilitating secure HTTPS connections.

- Webhook Implementation – All gateways support webhooks to notify businesses of successful payments, chargebacks, and refunds as well as to enable automated transaction notifications.

Integration of an online payment gateway in an appropriate manner builds user confidence, reduces payment inconvenience, and ensures secured transactions. Following the best practices and putting the technology first, business companies are able to create a strong and smooth payment system for business development.

Security and Compliance

Handling online transactions requires more than just a functional system—it demands strong security protocols to protect both businesses and customers. A well-executed payment gateway integration process ensures that sensitive payment data remains secure while complying with industry standards like PCI DSS (Payment Card Industry Data Security Standard). Businesses that neglect these security protocols expose themselves to fraud, data breaches, and financial losses, which can considerably impact their business and reputation.

To provide a secure online payment integration, encryption, tokenization, and secure authentication protocols must be the top priority for businesses.. Encryption ensures that customer payment details are transmitted safely without being intercepted by malicious actors. Tokenization replaces actual card details with a unique token, reducing the risk of data exposure. Multi-factor authentication adds another layer of protection, verifying the legitimacy of transactions before approval.

Security never stops at integration—it must be continuous and subject to periodic updating. Regular system audits identify weak points before they can be exploited. Fraud protection features, such as monitoring unusual payment patterns, block unauthorized payments. Secure facilities and firewalls hosting also shield payment details against cyber attacks. By being continuously on guard and taking decisive security measures, organizations maintain their payment gateway compliant and also immune to new threats that may arise.

Troubleshooting Common Issues

Integrating a website with a payment gateway may be accompanied by issues even with a properly designed setup. The most common issue is transaction failure because of the improper setting of APIs or connection issues between the payment gateway and the business’s backend system. Payment rejections based on fraud detection or insufficient funds also frustrate customers and lead to incomplete transactions.

Slow processing is another frequent issue. Payment authorizations can be delayed due to the server workload being heavy or because the site infrastructure and gateway are incompatible. Security errors on the assumption that gateways will reject transactions as they are probable threats and would need to be examined manually or further subject to verification procedures need to be expected by the merchants.

These problems must be addressed through careful troubleshooting. Ongoing API testing and monitoring detect problems prematurely. Software and security updates minimize compatibility and fraud detection issues. Proper customer communication, such as providing additional payment options in case of a failed transaction, improves customer experience. By tackling these integration challenges adequately, businesses are able to guarantee a smooth and stable payment system, without the disruption of transactions.

Why Choose Scrile for Your Integration Needs

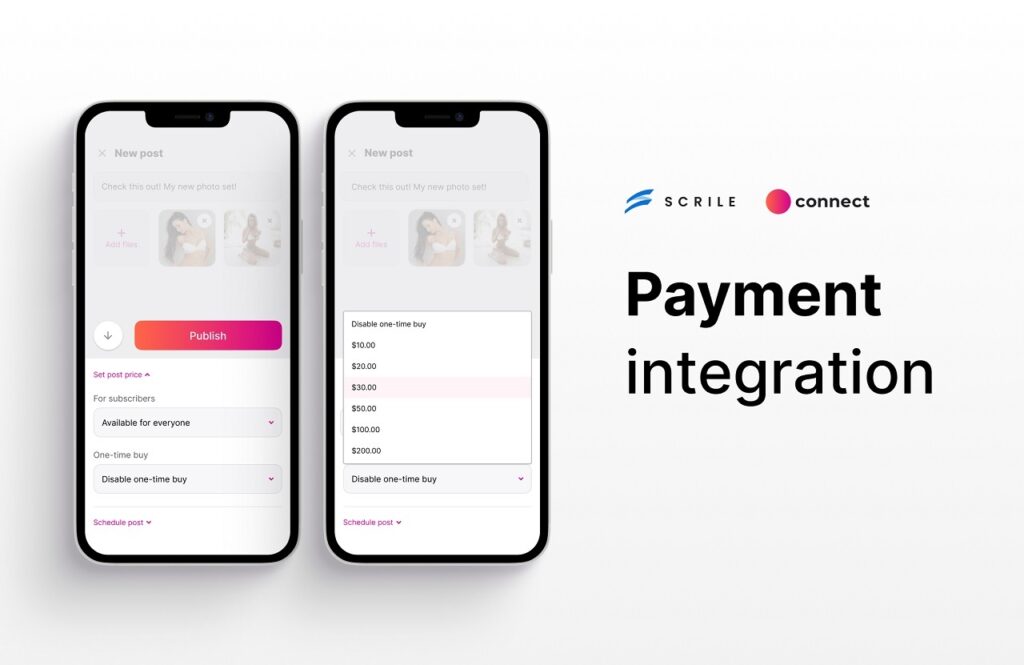

A one-size-fits-all payment gateway might be adequate for some businesses, but most businesses need a solution tailored to their operations. Scrile payment gateway integration is customization-focused, allowing businesses the freedom to create a system that is bespoke to their payment processing needs. From processing one-time payments, recurring subscriptions, or multi-vendor payments, Scrile enables seamless, secure, and scalable integration.

Custom Solutions by Scrile

- Flexible payment processes: Tailor the payment gateway to your business model, whether an online store, a subscription-based digital business, or a tiered-pricing site.

- Multi-currency support: Allow global transactions without friction, ensuring smooth payments across different regions.

- Enhanced fraud protection: Implement security features tailored to your industry to minimize risks and chargebacks.

Benefits of Choosing Scrile

- Industry expertise: Scrile has experience in payment solution integrations for social media platforms, SaaS products, online marketplaces, and high-risk industries where default gateways are unable to provide what is required.

- Streamlined transaction processing: Minimize declined payments and frictional checkout with an optimized gateway integration.

- Scalability and compliance: Get ahead of evolving regulations while having a system that grows with your business.

Long-Term Reliability and Support

- Continuous monitoring and updates: Payment gateways require adjustments over time. Scrile ensures ongoing optimization to maintain performance.

- Technical support and troubleshooting: Get expert assistance when needed, preventing disruptions in transactions.

- Adaptability to new payment technologies: As new methods emerge, Scrile helps businesses integrate them seamlessly.

With Scrile payment gateway integration, businesses gain more than just a payment processor—they get a customized, reliable system that enhances revenue, security, and user experience.

Conclusion

Professional payment gateway integration is the cornerstone of smooth transactions, security, and customer satisfaction. The right gateway enables smooth payment processing, reduces declined transactions, and enhances business trust. Every business having different requirements makes the customized approach the differentiator.

Scrile payment gateway customized solutions are designed to meet specific business needs for efficiency and security. For a hassle-free and scalable payment system, explore Scrile’s expert solutions today. Let their professionals help you design a secure, fully integrated payment gateway that optimizes your customer experience and long-term success.

Polina Yan is a Technical Writer and Product Marketing Manager, specializing in helping creators launch personalized content monetization platforms. With over five years of experience writing and promoting content, Polina covers topics such as content monetization, social media strategies, digital marketing, and online business in adult industry. Her work empowers online entrepreneurs and creators to navigate the digital world with confidence and achieve their goals.