Getting approved for standard payment processing isn’t always straightforward. Some businesses face higher risks due to industry regulations, increased chargeback rates, or fraud concerns. Traditional payment processors often refuse to work with these businesses, leaving them with limited options for accepting online transactions. This is where high-risk payment processors come into play, offering specialized solutions that cater to industries with higher financial and regulatory complexities.

A high-risk payment processor is a provider that works with businesses considered too risky for traditional banks and merchant service providers. These processors ensure that companies in industries such as adult entertainment, gambling, CBD, forex trading, and subscription-based services can securely accept payments. They offer tailored fraud prevention, chargeback management, and compliance tools, allowing businesses to operate smoothly despite their classification.

For businesses operating in the mentioned industries, high-risk payment processing is not merely a choice but the obligatory requirement. Otherwise, the company will risk losing clients, sales, and reputation. Choosing the right high-risk payment gateway is the solution to secure transactions, compliance with the law, and the convenience of the payment process. Here is the review of the best high risk payment processors, what they are, and what to pay attention to while choosing the provider.

What Are High-Risk Payment Processors?

A high-risk processor is a merchant services company that deals in transaction processing services to merchants that banks and general merchant account providers will not service. These merchants are high risk due to the incidence of higher chargebacks, government regulation, or operating within a merchant category that is more vulnerable to fraud than others. As opposed to the usual merchant account that handles low-risk merchants with established transaction histories, high-risk processors are designed to handle unknown patterns of finance as well as increase security and anti-fraud protection.

| Processor | Best For / Industries Served | Key Strengths | Potential Limitations |

|---|---|---|---|

| PayKings | Adult, CBD, iGaming, international merchants | Customized accounts, fraud & chargeback protection, global reach | Higher fees for very high-risk industries |

| Durango Merchant Services | Tech support, subscriptions, debt collection | Customized risk-mitigation strategies, multi-currency support, fraud filtering | Longer approval times |

| Soar Payments | Tech support, e-commerce, travel, subscription models | Integrated fraud protection, recurring billing support, flexible payment models | Industry restrictions in some regions |

| Authorize.Net | High-risk e-commerce, businesses needing fraud tools | Advanced fraud protection (AVS, CVV), reliable gateway, trusted provider | Less flexible for newer high-risk sectors |

| NMI Payment Gateway | Businesses needing multi-platform support | Multi-merchant processing, 150+ shopping cart integrations, advanced reporting | Requires technical setup for customization |

| eMerchantBroker (EMB) | CBD, adult, online casinos, crypto merchants | Global presence, chargeback reduction, crypto support | Higher per-transaction fees |

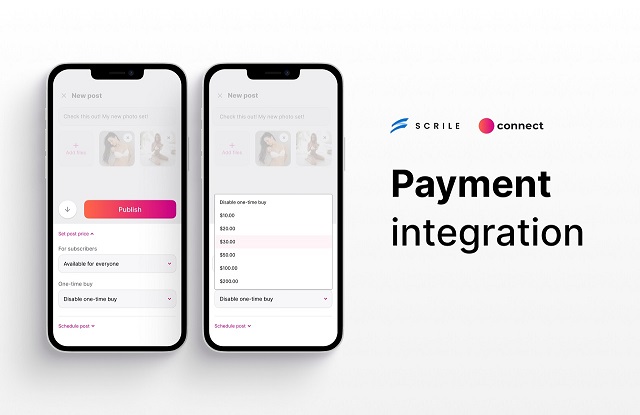

| Scrile | Adult entertainment, coaching, subscription platforms, marketplaces | Fully custom integrations, multi-gateway support, PCI DSS compliance, fraud/chargeback management | Requires development partnership (not plug-and-play) |

Industries Considered High Risk

Certain sectors are automatically flagged as high risk due to their transaction patterns, regulatory challenges, or industry reputation. Some of the most common high-risk industries include:

- Adult entertainment – Subscription-based and pay-per-view adult content platforms often experience high refund and chargeback rates.

- CBD and cannabis – Despite legalization in many regions, CBD transactions remain highly regulated, making it difficult to find mainstream payment solutions.

- Gambling and online gaming – High transaction volumes and potential fraud risks make online casinos and sports betting platforms a challenge for traditional processors.

- Forex trading and cryptocurrency exchanges – These industries deal with volatile markets, high-value transactions, and strict financial regulations.

- Subscription services and recurring billing models – Businesses that rely on automatic renewals often face higher chargeback rates due to customers disputing charges they forgot about or didn’t authorize.

Why Businesses Need High-Risk Payment Processing

For high-risk businesses, it is important to identify a reliable high-risk payment processor. One of the most significant issues is chargeback management—when the customers dispute transactions, excessive chargebacks can lead to the cancellation of accounts. A high-risk processing expert offers solutions to prevent, track, and dispute chargebacks before they disrupt business operations.

Another priority is security. There are higher levels of fraudulent charges in high-risk industries and therefore high-risk processors will need to implement advanced fraud detection systems and encryption methods to protect businesses and their customers. Compliance with industry regulations—such as anti-money laundering law and finance report mandates—requires the services of a high-risk payment processing provider that is experienced in navigating intricate legal systems and offers compliance-oriented services.

Without an appropriate high-risk payment processor, businesses are unable to process payments, leading to missed sales and frustrated customers. An appropriate provider ensures secure transactions, regulatory compliance, and financial viability in the long term.

How High-Risk Payment Processing Works

Businesses categorized as high risk require specialized high-risk payment processing to handle transactions securely. Unlike standard merchant accounts, these businesses need solutions that account for chargeback risks, fraud prevention, and industry-specific regulations. A high-risk payment gateway plays a crucial role in ensuring smooth transactions while minimizing potential financial threats.

Merchant Account Setup

To be able to make the payments, high-risk businesses need to set up a high-risk merchant account. The high-risk merchant account is set up to accommodate businesses that have a higher rate of chargebacks, including adult entertainment, subscription-based services, and internet gambling. The merchant account serves as the intermediary between the bank, payment gateway, and the business to process the transaction approval and settlement in the correct manner.

High-risk accounts differ from regular merchant accounts in that they usually have higher processing rates because of the greater risk banks and payment processors take on. But they provide greater flexibility in that businesses can process payments that would be denied by ordinary providers.

Approval Process for High-Risk Businesses

Getting approved for a high-risk payment gateway involves a more extensive review than a standard merchant account. Payment processors evaluate several factors before approving a business, including:

- Industry type – Businesses in sectors prone to fraud or regulation-heavy industries face stricter scrutiny.

- Transaction history – A company with a history of excessive chargebacks may struggle to find a suitable processor.

- Financial stability – Payment processors assess a company’s financial health, ensuring it can manage refunds, chargebacks, and fees.

- Compliance and security measures – Businesses must demonstrate adherence to legal requirements, such as PCI DSS compliance.

Risk Mitigation in High-Risk Payment Processing

Since high-risk industries have more fraud and disputes, high-risk payment options include more advanced fraud detection, encryption, and chargeback protection. The majority of the payment processors use AI-based fraud prevention tools to detect unusual transaction behavior and mark it as suspicious. The chargeback protection services also make it possible to lower losses since it allows businesses to dispute false claims and catch repeated transaction issues.

A high-risk gateway offers the facility to make secure payments while protecting the businesses from risks to their finances, the law, and continuity of business.

Best High-Risk Payment Processors in 2026

Finding the right high-risk merchant processor is essential for businesses facing payment restrictions due to industry classification. Some providers specialize in handling businesses with frequent chargebacks, regulatory concerns, and fraud risks. Below, we break down some of the best high-risk payment processors and gateways that offer secure and reliable transaction solutions.

PayKings

PayKings is a highly reputable high-risk merchant processor that provides customized merchant accounts to adult entertainment, CBD, and iGaming businesses and other industries. It offers fraud protection services, chargeback protection features, and seamless integration with numerous gateways of payment. The company also supports business entities from restricted regions, making it the best choice for international high-risk merchants.

Durango Merchant Services

Durango deals with high-risk businesses that have high probability of chargebacks, like tech support businesses, subscription-based companies, and debt collection agencies. Durango’s unique selling point is that it is able to offer customized account management so that businesses are able to create risk-mitigation strategies. Its high-risk payment processing services encompass multi-currency processing and fraud filtering to enable secure transactions in high-risk businesses.

Soar Payments

Soar Payments is the perfect choice for tech support, e-commerce, and travel businesses that experience numerous chargebacks. With the firm’s full-integrated fraud protection features, the company is able to process payments while minimizing risks. With its support of numerous models of payments like one-time buy and recurring billing, Soar Payments is perfect for businesses that sell subscription models.

Authorize.Net

Authorize.Net is one of the trusted and veteran players in the payment processing business that targets businesses that need advanced fraud protection. As a high-risk gateway payment processor, it offers secure transaction processing and services such as address verification services (AVS) and card code verification (CVV). Mostly, businesses that experience multiple fraudulent transactions utilize its advanced protection features to process secure payments over the internet.

NMI Payment Gateway

NMI is a highly flexible high-risk processing solution that allows businesses to customize their payment integration. With features like multi-merchant processing, advanced reporting, and compatibility with over 150 shopping carts, NMI offers a scalable gateway that adapts to unique business needs. It is particularly useful for businesses with complex payment structures or those needing multi-platform support.

eMerchantBroker (EMB)

EMB is also an international high-risk merchant processor that provides solutions to CBD, adult, and online casino businesses. It provides tailored fraud protection, chargeback reduction programs, and other payment solutions, including support for cryptocurrency. Due to EMB’s global presence, it is ideal for companies that must go global while providing secure transactions.

Factors to Consider When Choosing a High-Risk Processor

Choosing the correct high-risk processor involves a very close examination of some very key factors. High-risk payment processors differ from standard payment providers because they have higher fees and provide specialized services for fraud, chargeback, and compliance.

Some of the largest issues are transaction fees and rates. Due to the higher risk of fraud and chargebacks, higher-risk processors generally cost more, in the range of 3% to 10% per transaction. Companies will then have to weigh up the benefits of the specialist provider against the cost.

High-risk processors also vary widely in chargeback policies. Some include chargeback prevention features, while others offer dispute assistance. A good chargeback management is what the ideal high-risk processor should possess to minimize the loss of finance.

For companies operating internationally, global payment support is essential. The ability to accept multiple currencies and process payments across different regions ensures scalability and market expansion.

Lastly, integration and security should not be overlooked. The best high-risk payment solutions provide robust API support, end-to-end encryption, and fraud detection to keep transactions secure while ensuring a seamless user experience.

Why Scrile is the Best Choice for High-Risk Payment Processing

Finding the right high-risk payment solutions can be challenging, especially for businesses operating in restricted industries. Unlike generic providers, Scrile high risk payment processors offer tailored integrations designed to meet the specific needs of high-risk businesses.

Custom Solutions for High-Risk Industries

Scrile understands that every business has unique payment processing requirements. Instead of offering a one-size-fits-all approach, it provides custom high-risk payment processing integrations that align with different business models. Whether a company operates a subscription-based service, an online marketplace, or an adult entertainment platform, Scrile develops solutions that ensure seamless transactions and long-term reliability.

Industry-Specific Expertise

Many payment processors avoid working with businesses in industries like gaming, adult services, and high-risk e-commerce. Scrile specializes in these sectors, offering payment gateway integrations that support multi-currency transactions, fraud detection, and chargeback management. This expertise helps businesses avoid sudden account freezes or rejected payments, ensuring smooth financial operations.

Scalability and Compliance

Growing businesses need a payment solution that can scale with them. Scrile integrates PCI DSS-compliant security measures, advanced fraud prevention tools, and compliance support for international payments. This ensures that businesses can expand into new markets without facing regulatory roadblocks.

Seamless Integration with Multiple Payment Gateways

Unlike many high-risk payment processors that offer limited integration options, Scrile works with multiple high-risk payment solutions to provide businesses with flexibility. Whether using Stripe, PayKings, or custom-built payment systems, Scrile ensures full compatibility with existing platforms, making transactions more secure and efficient.

Conclusion

Selecting the right high-risk payment processors is essential for security, compliance, and smooth financial operations. Businesses in high-risk industries need reliable solutions that prevent fraud, reduce chargebacks, and ensure seamless transactions. Explore Scrile’s custom payment integration services to build a secure, scalable system tailored to your business needs. Strengthen your payment processing today with a trusted partner.

Polina Yan is a Technical Writer and Product Marketing Manager, specializing in helping creators launch personalized content monetization platforms. With over five years of experience writing and promoting content, Polina covers topics such as content monetization, social media strategies, digital marketing, and online business in adult industry. Her work empowers online entrepreneurs and creators to navigate the digital world with confidence and achieve their goals.